To date, electromobility is the only promising approach for a comprehensive decarbonization of global road transport. The task for the coming decades is enormous. According to BNEF, there are globally:

- 1.3 billion cars

- 170 million vans (LCV <3.5t)

- 83 million HDVs (trucks and other heavy commercial vehicles >3.5t) and

- 3.4 million buses.

In terms of climate policy, passenger cars are in first place with a 50% share of CO2 emissions in road transport, followed by trucks (HDVs) with 30%.

1. Global electric car sales 2024 and 2025

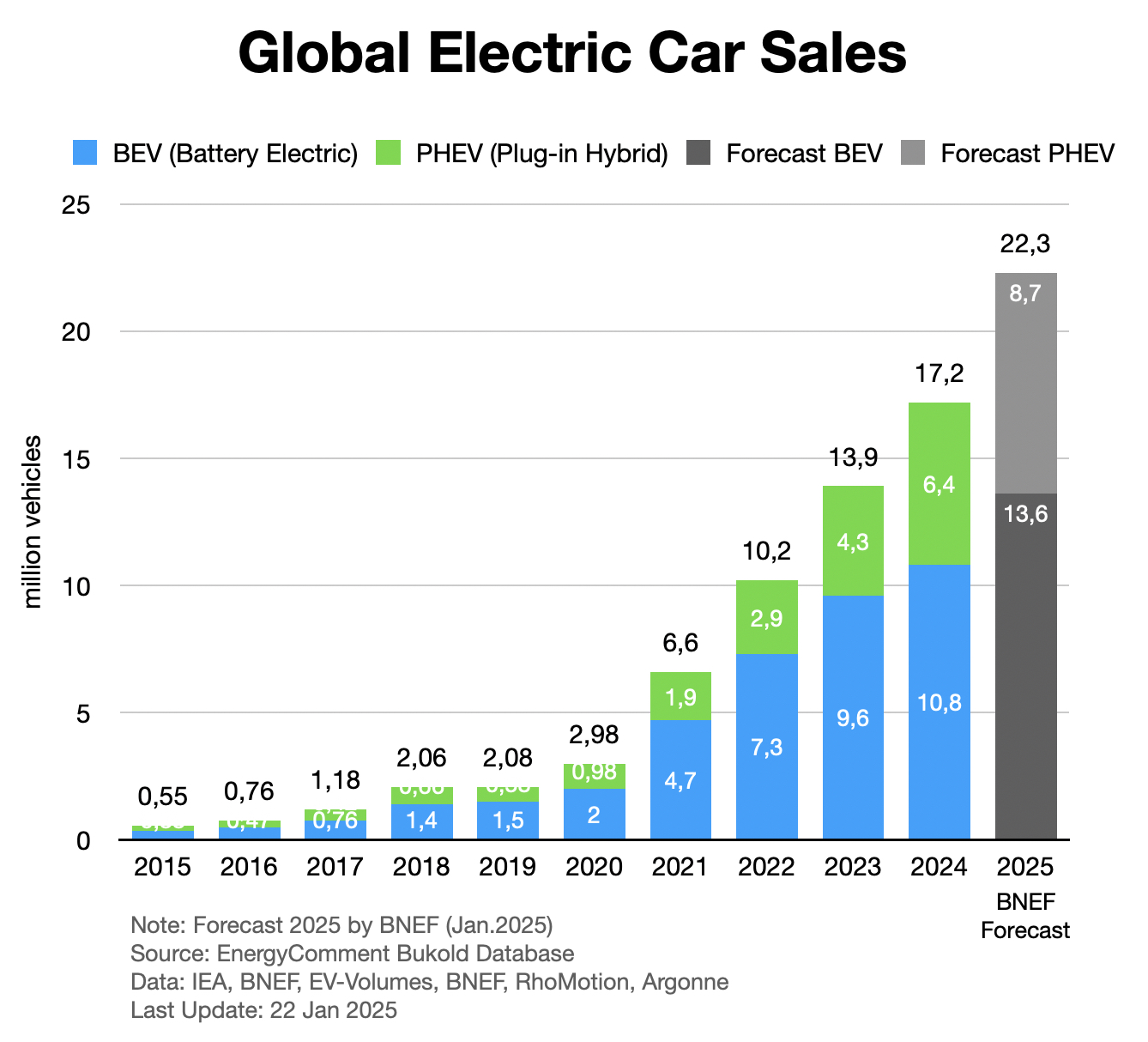

The electric car industry has slowed to a linear growth path in recent years, with a strong focus on China. According to preliminary figures from BNEF, 17.2 million electric cars (EV) were sold worldwide in 2024 (RhoMotion: 17.1 million). This is 24% more than in the previous year.

The share of BEVs (purely battery electric cars) has been falling since 2023 in favor of PHEVs (plug-in hybrid vehicles), which are in particularly high demand in China. In general, it can be observed that the batteries in plug-ins are becoming larger and are also being used more and more frequently.

Most forecasts anticipate comparable or slightly stronger growth in the industry in 2025. BNEF expects sales of 22.3 million electric cars (+30%). The share of PHEVs will continue to rise and could amount to 39% or 8.7 million vehicles in 2025.

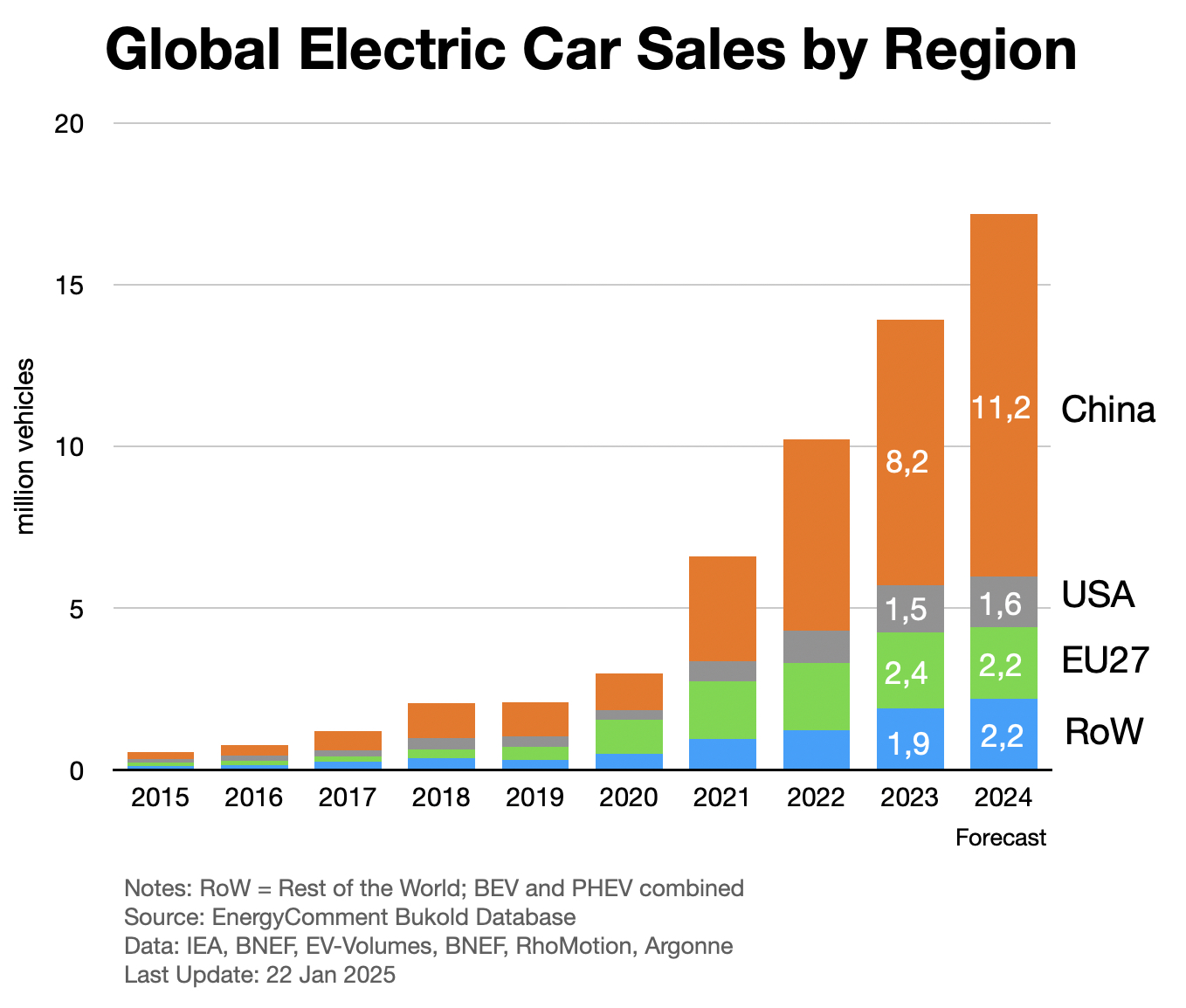

Global growth is increasingly concentrated in China, as the following chart shows. In 2024, 65% of electric cars were sold there.

In the rest of the world, sales only increased by just under 5%. In the EU, they even fell from just under 2.4 million to 2.2 million vehicles in 2024, which is mainly due to the slump in Germany. In the USA, they rose more strongly than expected from 1.5 to 1.6 vehicles, which was not yet foreseeable in summer 2024.

In the EU, hopes are now pinned on the stricter EU regulations for car fleets, which came into force at the beginning of 2025. On the other hand, the situation in the USA is unclear. The first presidential orders from the new administration are clearly intended to slow down the growth of the EV sector.

In important markets such as Japan, India and Brazil, electric cars are still a marginal phenomenon. Growth rates are very high in some cases, but the starting point is modest.

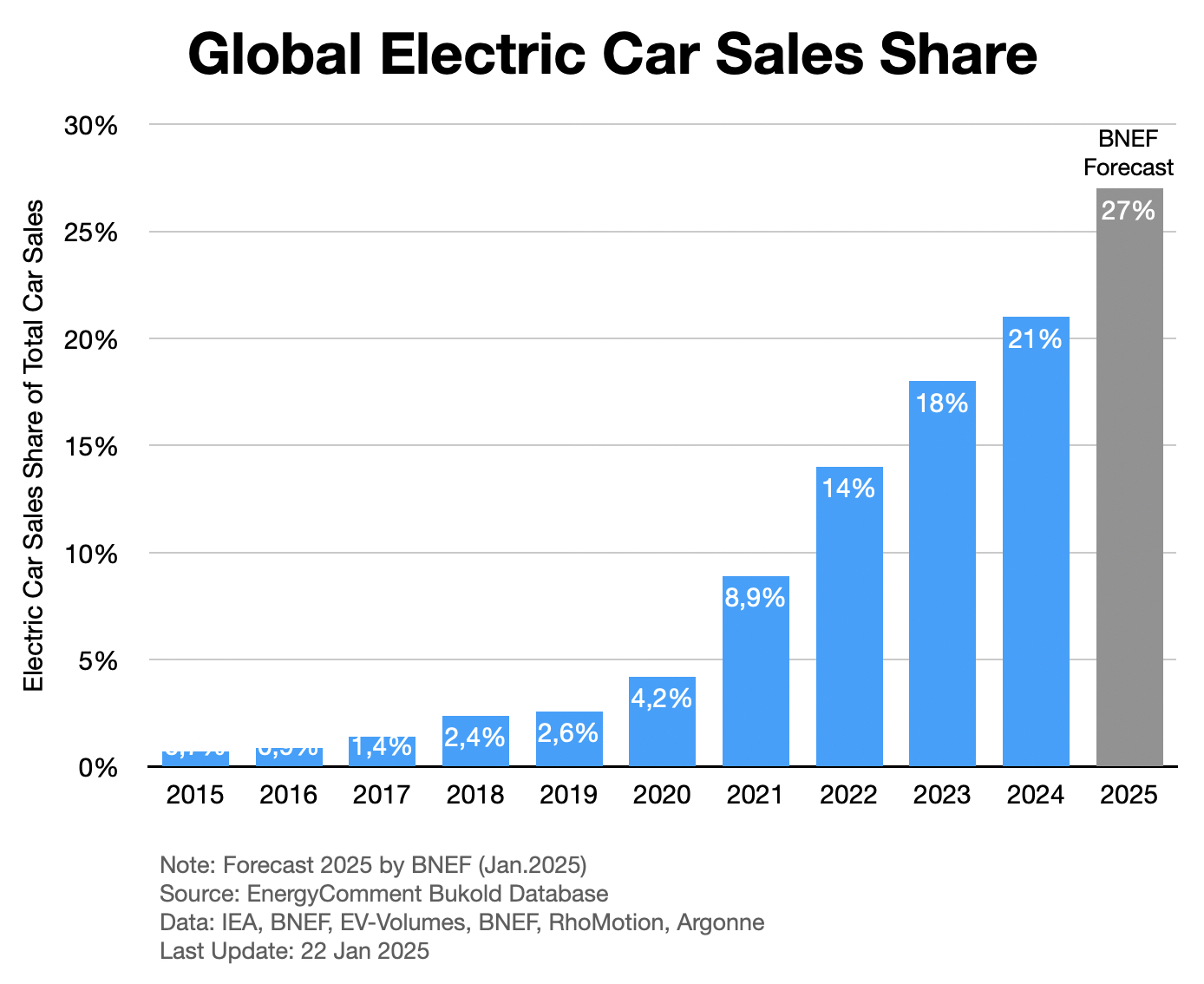

A global transition on the roads („Verkehrswende“) is not yet in sight. In 2024, the share of electric cars (BEV/PHEV) in total new registrations only rose from 18% to 21%. If the BNEF forecast for 2025 is confirmed, the share will climb to 27% this year. Other forecasts are more cautious, but also expect a rising market share.

Whatever the case, the global tipping point is still a long way off. The situation is different in China, where the 50% mark was surpassed for the first time in August 2024. In the current year, even the annual average will be above 50%.

If you look at the entire car stock, the situation looks different again. Only around 4% of the global fleet of passenger cars is already electrified.

2. E-Trucks, E-Vans, E-Buses (2015-2023 numbers)

Reliable numbers for global e-trucks, e-vans, and e-bus fleets are not available yet. The following figures therefore refer to the year 2023. Source is the IEA EV Database.

2.1 E-Trucks

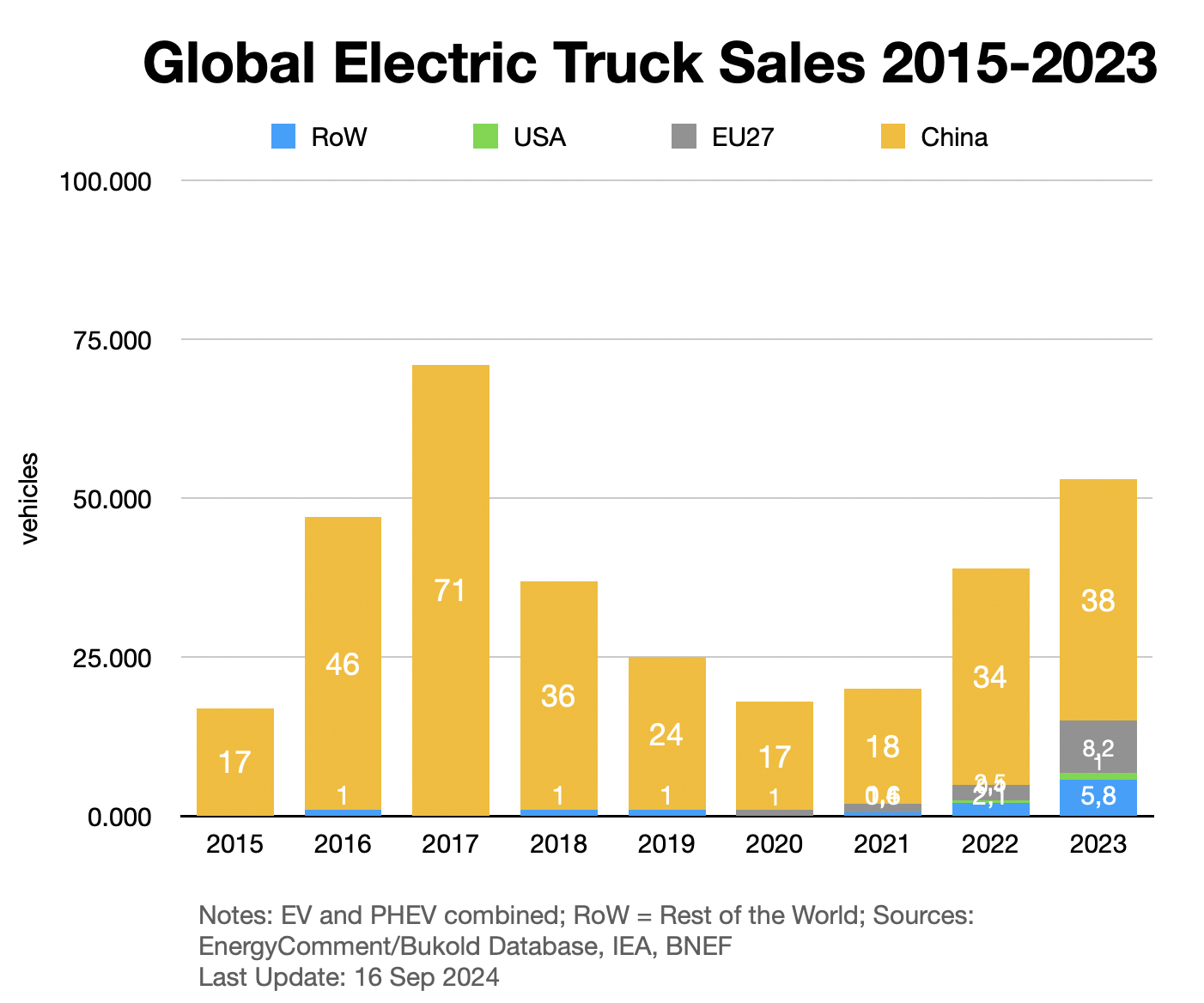

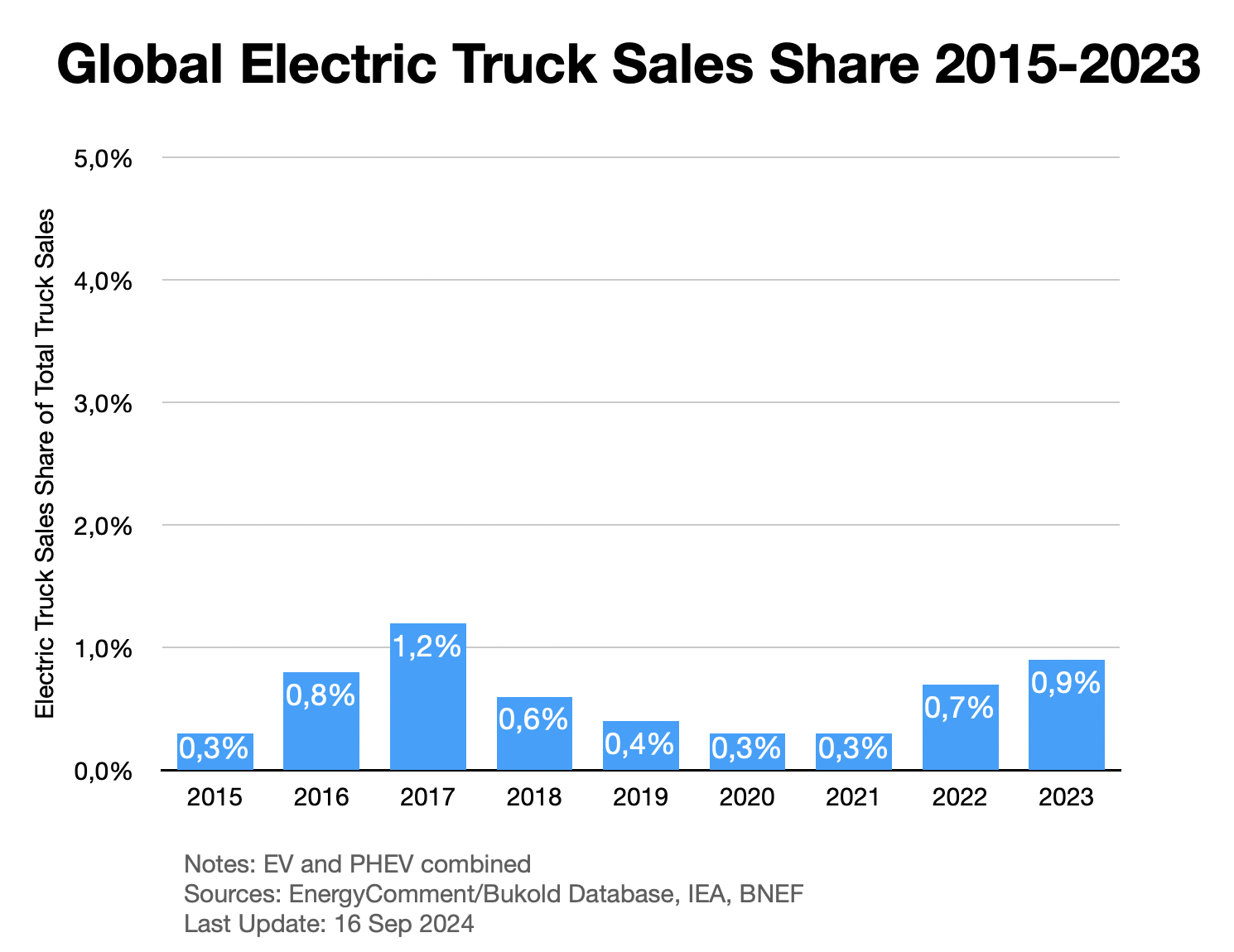

Global sales figures for e-trucks (medium and heavy BEV trucks; PHEVs do not play a significant role in this segment) do not show a clear trend until 2023. Significantly increasing volumes are not expected until the next few years. As with e-cars, the show so far is almost exclusively in China. Almost 72% of the 53,000 e-trucks are being used there.

The proportion of new vehicles is correspondingly low. Only 0.9% of new trucks are powered by batteries. A breakthrough into double-digit percentages, as with electric cars, is not yet in sight.

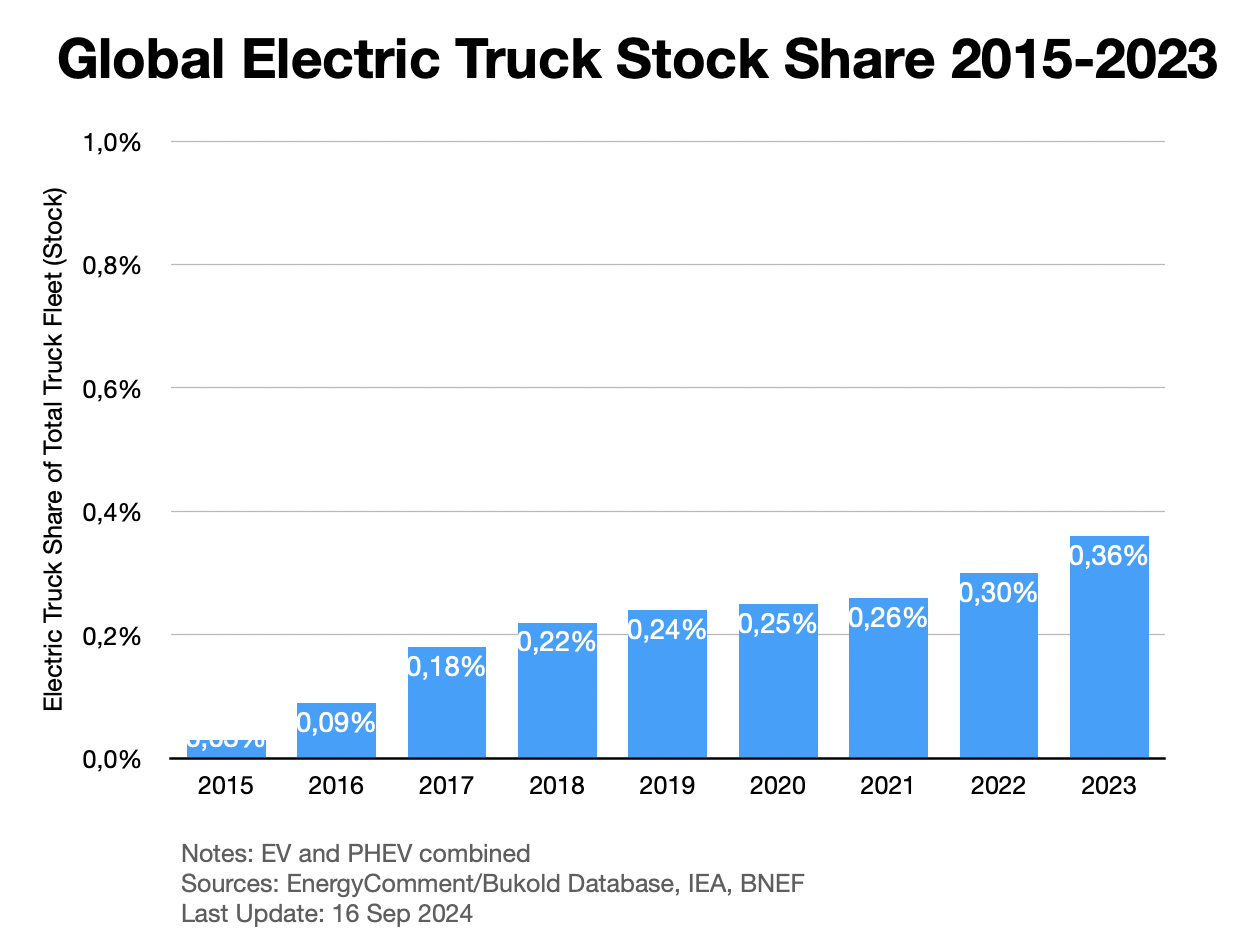

The proportion of the global truck fleet is even lower. Only 0.36% of the existing fleet is electric. Here too, a breakthrough is still a long way off.

2.2 E-Vans

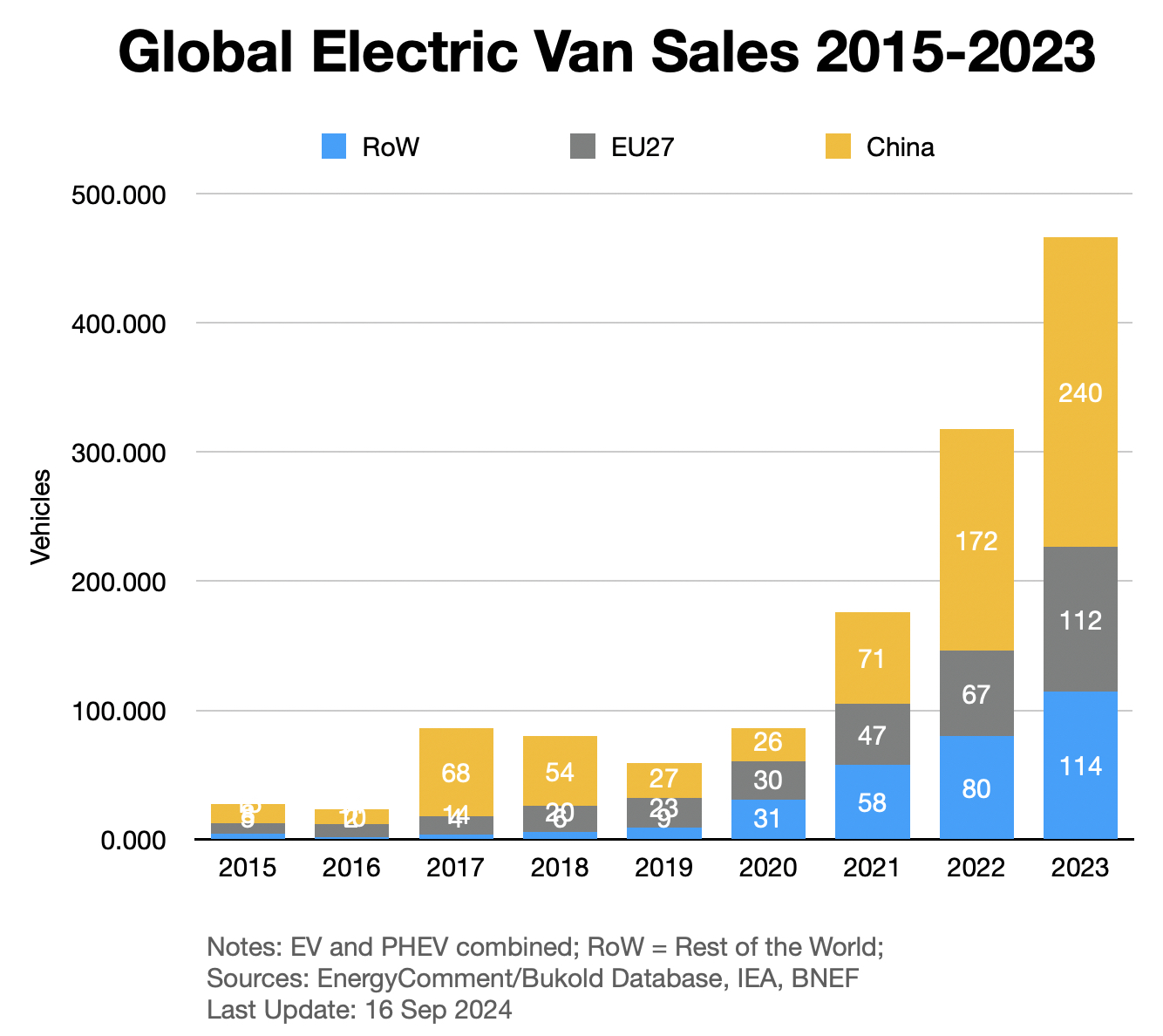

Small commercial vehicles up to 3.5 tons, which are used for delivery services or craft businesses, for example, benefit from the technical proximity to e-cars and their use in inner-city areas. Sales figures rose significantly after 2020. In contrast to cars and trucks, China’s dominance is less pronounced here. Just under half of global sales took place outside China.

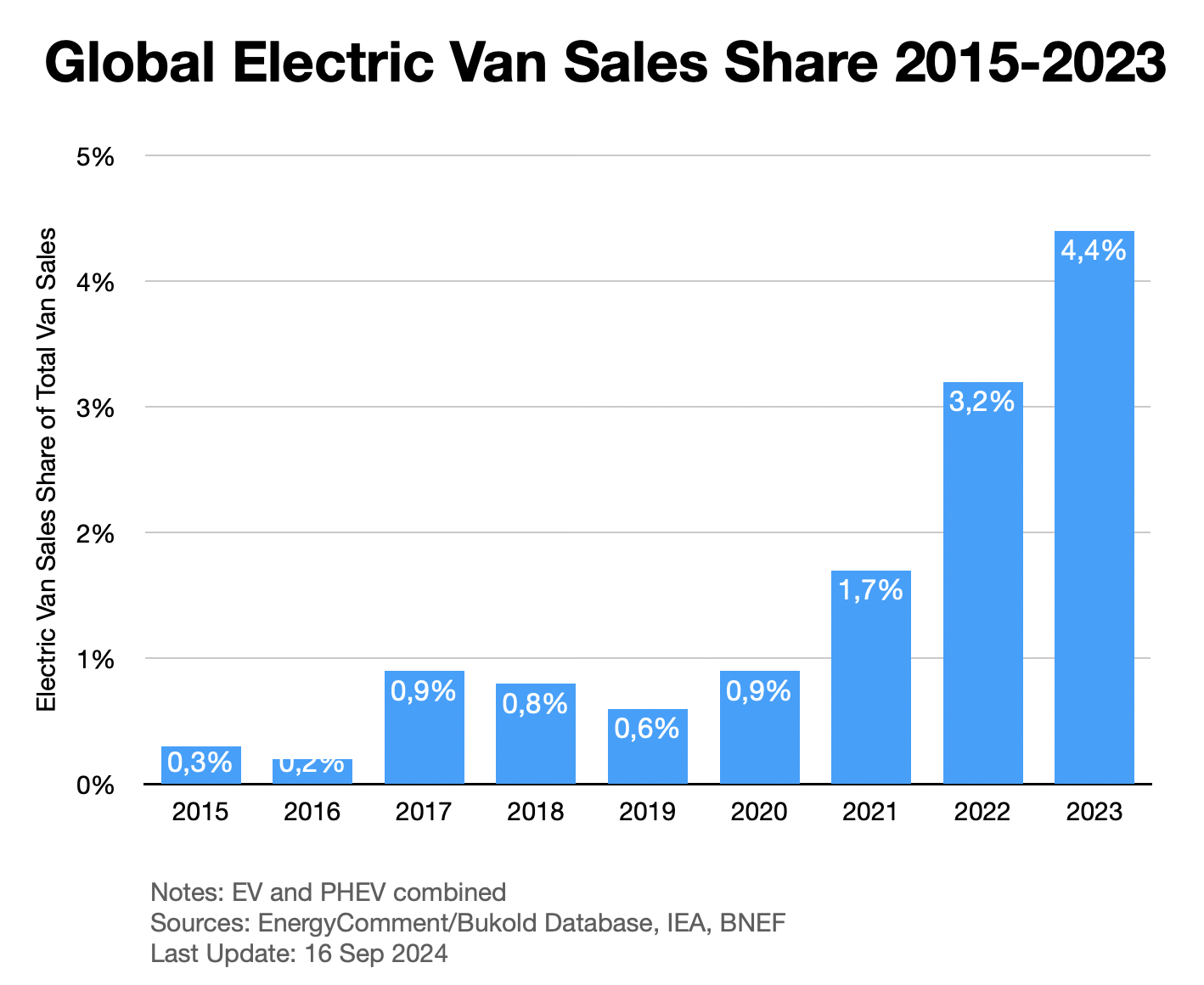

Nevertheless, its share of new sales is still low. It stood at 4.4 percent last year, but is growing strongly.

As electric vans have only been in significant numbers for a few years, their share of the existing fleet is still very low. Only 0.9 percent of vans worldwide are electrically powered.

2.3 E-Buses

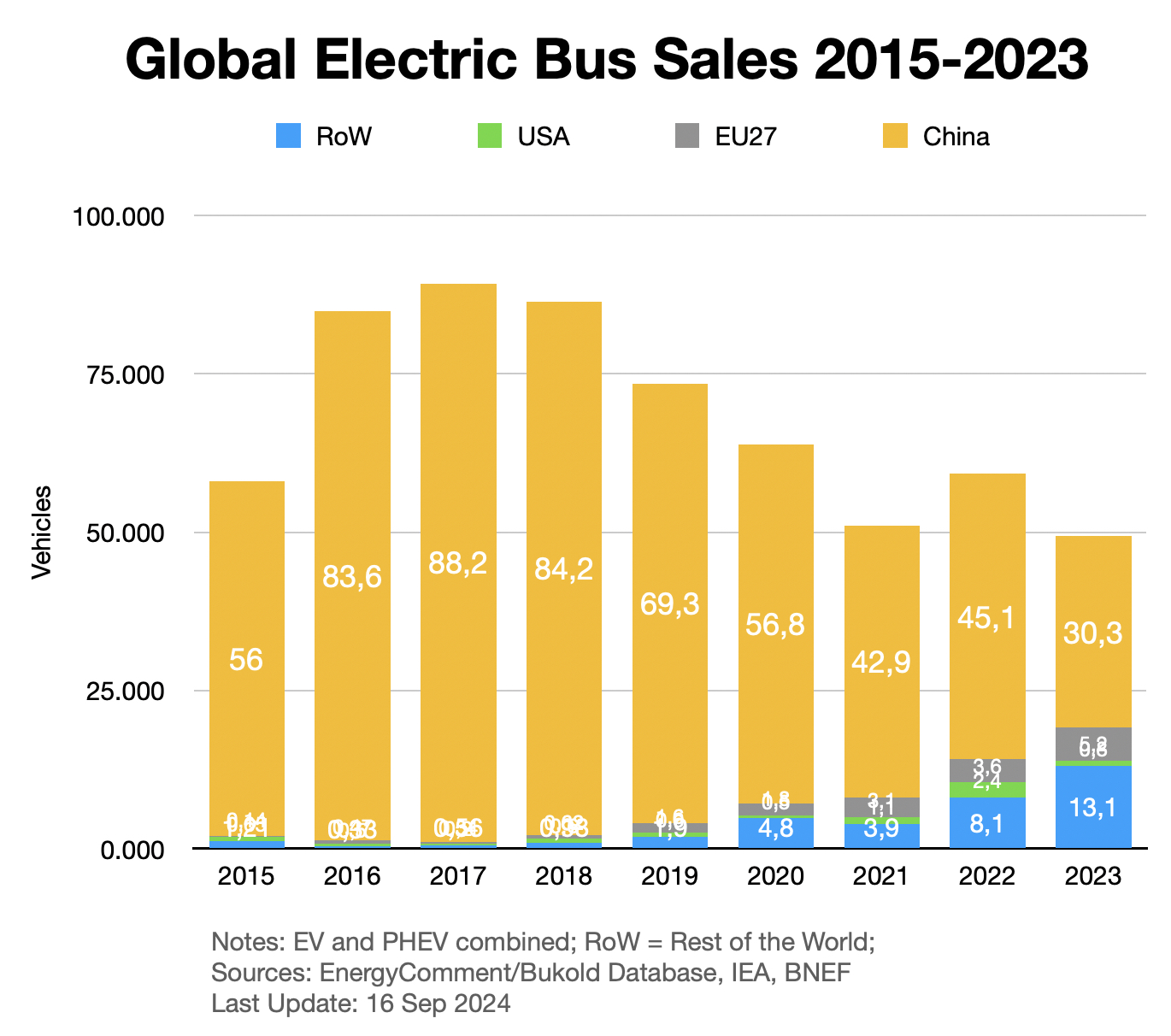

Compared to other vehicle types, the number of new e-buses is falling at a completely atypical rate. This is almost exclusively due to the fact that China was an early adopter of e-buses and is now experiencing market saturation.

The following chart therefore shows the decline in new registrations in China, while the figures in the rest of the world are rising – albeit from a very modest level. As a result, China’s market share was still just over 60% in 2023.

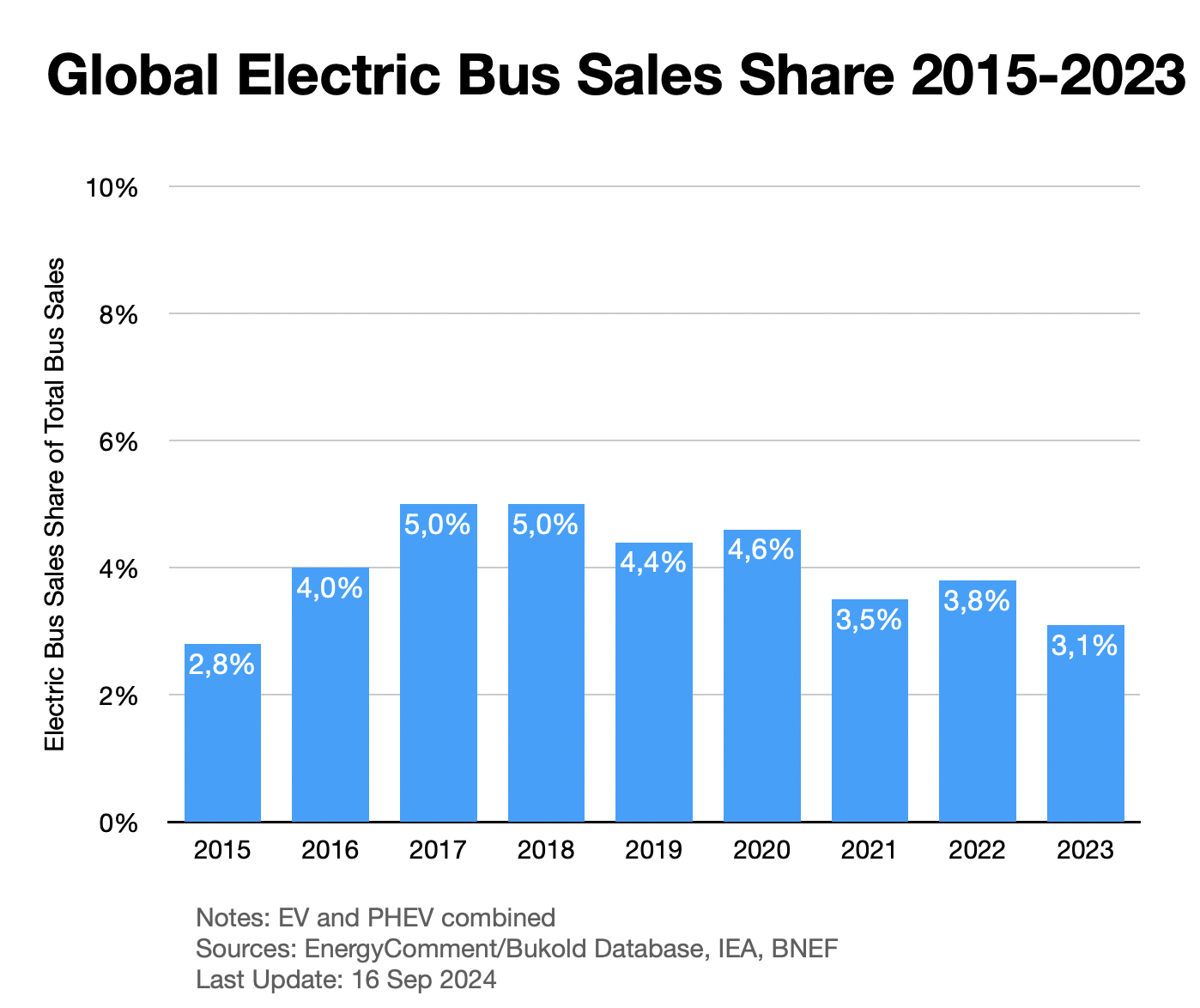

The global trend has so far been disappointing. Only 3.1 percent of new buses sold last year belonged to the electric segment.

Nevertheless, China’s early advance means that e-buses now account for 3.6 percent of the global bus fleet. This is 10 times more than for e-trucks and similar to the figure for electric cars.