E-fuels are a hot topic that immediately brings any car-related discussion in Germany and many other countries to a boil. For some, they are the magic elixir that will secure the future of the combustion engine; for others, they are the new snake oil that blocks the path towards electromobility. Based on Karl Valentin´s “Everything has already been said, but not yet by everyone”, I am also presenting the topic here, mainly because many debates are currently fizzling out because there is no agreement on the basic facts and figures.

1. What are e-fuels?

The question is not trivial, because the term is currently used very different ways.

1. As is well known, almost all fuels used in road, sea and air transport are currently fossil fuels, i.e. oil products such as petrol, diesel, kerosene or fuel oil, or they consist of natural gas (CNG/LNG).

2. The second group is biofuels, which are produced from fats/oils or starch/sugars. Bioethanol and biodiesel form the largest groups here. HVO and UCO also belong to this category. However, HVO in particular is sometimes subsumed under the heading of e-fuels.

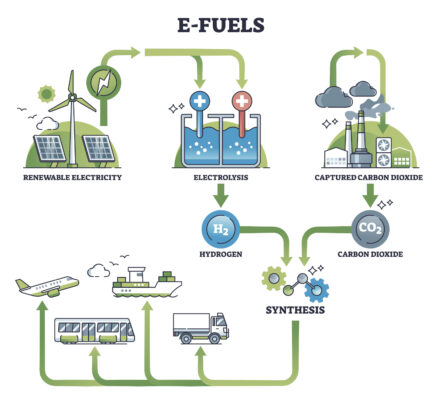

3. A third, very heterogeneous group is synthetic fuels. Here, a synthesis gas (syngas) is first produced, which consists of hydrogen (H2) and carbon monoxide (CO). The raw materials for this can be of fossil origin (gas-to-liquids, coal-to-liquids), produced from biomass (BtL), or from electrolysis hydrogen plus climate-neutral CO2. E-fuels are a subgroup within this large group of synthetic fuels.

There are further terms that cut across these three groups:

- “Drop-in fuels” are fuels that can be blended into conventional fossil fuels, even in large proportions, or can replace them completely. They are mostly adapted biofuels with a higher hydrogen content and optimized chemical properties.

- “RFNBO”: This clumsy abbreviation means “Renewable Fuels of Non-Biological Origin” in legal EU jargon, thus excluding fossil fuels and biofuels. What remains belongs to the RFNBOs. This coincides to some extent with the e-fuels, although this list is not defined technically or materially, but is the result of political negotiations. Thus, the CO2 used for RFNBO may well be biogenic.

As mentioned, e-fuels belong to the third group, i.e. synthetic fuels.

1. The name already suggests that electricity (instead of natural gas or coal) is used to produce the hydrogen necessary for e-fuels. This has to be low-carbon electricity, i.e. primarily solar or wind power. Even with a small proportion of fossil fuels, the production of e-fuels is no longer worthwhile, since 70-80% of the energy is lost in the complex production chain. After the subsequent inefficient combustion in the engine, only 10-15% of the original energy input actually reaches the wheels.

The current German electricity mix would therefore be unsuitable for the production of e-fuels. According to the IEA, e-fuels only become less harmful to the climate than conventional fuels when the climate impact is below 130g CO2 per kWh of electricity. In Germany, it is currently 380g.

2. In most definitions, CO2 is the second necessary component for producing e-fuels. More on this further below in a separate chapter.

From here on, opinions differ when it comes to the question of what belongs to e-fuels and what does not. The classification is quite arbitrary:

- Green ammonia (e-ammonia, NH3), which could be particularly interesting for shipping, consists of hydrogen and nitrogen. CO2 or CO are not required and are therefore not produced during combustion. Sometimes green ammonia is counted as an e-fuel, sometimes not.

- There is broad agreement, however, that pure hydrogen (for fuel cells or combustion engines) is not an e-fuel, even if it is produced from green electricity.

- In the current political discussion in Germany, e-fuels are often defined even more narrowly, namely only as fuels for road and air traffic (e-gasoline, e-diesel, e-kerosene). Other areas of application, such as the chemical industry or shipping, are left out with this definition.

2. How are e-fuels produced?

The synthesis gas (H2/CO) can be further processed into fuels using a variety of methods. There are two main methods (and a few innovative, but not yet relevant, additional options):

2.1 Fischer-Tropsch synthesis (FT synthesis plus CO2 reduction)

In this complex process, which has been known for a century, first the indispensable synthesis gas is produced from hydrogen and carbon monoxide. This is then converted into syncrude, i.e. synthetic crude oil, a mix of long hydrocarbon chains.

This crude oil can then be processed in oil refineries, in a similar way to fossil crude oil, into oil products such as e-kerosene (e-SAF), e-naphtha, e-diesel or e-gasoline.

High temperatures, high pressure and expensive catalyst metals are necessary ingredients.

A second challenge is that the product mix can only be controlled to a limited extent. This means that inevitably a mix of products arises from the gas mixture. However, the output can be optimized during the FT process and subsequently in the refinery. This means that, depending on the target market, the proportion of kerosene, for example, can be increased to well over 50 percent, complemented by e-naphtha and e-diesel.

2.2 Methanol synthesis

In this process, methanol (CH3OH or MeOH), the simplest chemical alcohol, is produced from the synthesis gas mentioned above. In further steps, synthetic middle distillates such as diesel or kerosene can be produced. E-methanol (green methanol) can also be used directly for ship propulsion.

In China, methanol has been used in road traffic for a long time. However, it has been produced there from coal (coal-to-liquids) so far. Large plants that use green hydrogen are currently under construction.

2.3 The big problem: the CO2 procurement

In principle, green hydrogen can be produced anywhere there is solar or wind power. However, it can be much more difficult and expensive to provide the second raw material for the synthesis gas, i.e. the CO2 from which the necessary CO is obtained. The costs range from $20 to 600 per ton of CO2.

Three sources are available in principle:

1. The cheapest CO2 source is the factories of the competition, that is, biofuels. The production of bioethanol produces a highly concentrated CO2 stream that can provide the climate gas for as little as $20 per ton. Provided, of course, that the transport route to the Fischer-Tropsch plant is not too long.

The IEA estimates that by 2030, these ethanol plants could provide a maximum of 120 million tons of CO2 worldwide. In practice, it will be significantly less because there are also other uses, or because many plants are geographically inconvenient, or because the construction of CO2 pipelines is not possible.

Assuming a figure of 50 million tons, for example, this amount would be sufficient to produce an amount of e-kerosene that would only supply 2.5 percent of global air traffic. There would be nothing left for shipping or road transport.

2. A second source of CO2 could be capture plants at industrial plants or power stations (CCU). However, the costs here are already approaching $100 per ton of CO2. Since the combustion of e-fuels emits similar amounts of CO2 as fossil fuels, this would not be a climate solution anyway, since the emission of greenhouse gases would only be postponed but not prevented.

3. The ideal solution would actually be DAC, or Direct Air Capture. This involves filtering the CO2 out of the atmosphere, regardless of location. However, the effort involved is enormous: high costs of currently 500-600 euros per tonne of CO2 and a high energy input will probably only make DAC attractive in the long term, if ever.

The problem of CO2 procurement is often ignored by e-fuel supporters. They like to point out the low electricity costs “in sunny desert regions”, but it is precisely there that you will usually look in vain for bioethanol plants that could provide cheap CO2.

Without massive cost reductions in DAC plants, production will remain prohibitively expensive there as well. The pilot project Haru-Oni (Chile) by HIF/Porsche, which is often cited in the German media, is also experiencing this. Der Spiegel reported that the required CO2 is not yet, as stated on the company website, filtered out of the air using DAC, but is instead transported by truck from breweries far away.

Addendum: On December 12, 2024, HIF Global announced that a direct air capture system would be installed in the first quarter of 2025. However, its capacity is planned to be only 600 tons per year.

3. Visions and Reality in the E-Fuels Debate

3.1 Current quantities and projects

The usual media reading gives the impression that a lot is going on in the e-fuel sector. Apparently, plants are being ramped up everywhere, new processes are being brought into industrial use, and attractive products are being launched. But much of this is PR and is primarily intended to attract investors or mobilize the media.

Many start-up companies in this sector are technically innovative and present a variety of intruiging ideas in small pilot plants. However, it is still a long way to commercial production on an industrial scale, i.e. to generating revenues.

Even for large-scale projects that are well advanced, the road to e-fuels is obviously not a one-way street. The halt to the FlagshipONE project in Sweden in the fall of 2024 caused quite a stir. The Danish energy company Ørsted had planned to build the largest e-methanol plant in Europe there starting next year and produce various e-fuels from it. A final investment decision (FID) and commitments for government subsidies had long been made, but in the end the project was too risky for the Danes.

3.2 Leading companies

a) Infinium

Worldwide, there is currently only one (!) e-fuel production facility that could produce significant quantities.

Infinium’s Pathfinder plant in Corpus Christi, Texas, has been producing e-gasoline since spring 2024 and, according to plans, will also produce e-kerosene and e-naphtha from green hydrogen and CO2 from 2026. The next planned plant, Infinium Roadrunner, is primarily intended to produce e-SAF (e-kerosene) as well as smaller quantities of e-diesel and e-naphtha.

According to the company, the Pathfinder plant is already producing or will produce on an industrial scale. However, the current production volumes have not been published. In spring, they were a meager 8,300 liters per day. Since then, I am not aware of any update. To put this in perspective, this amount could cover global fuel consumption for 0.1 seconds (no, that’s not a calculation error).

It’s also best not to look too closely at the carbon footprint: the CO2 comes from a nearby natural gas processing plant (Howard Energy Partners). It was captured from a normal fossil natural gas mixture. This CO2 is released when the e-fuels are burned. The e-fuels are therefore anything but climate-neutral, but only slightly less harmful to the climate than fossil oil products.

b) HIF Global

Besides Infinium, HIF Global is the second most important company in the field of e-fuels. It has German involvement: the current CEO of HIF EMEA headed the energy policy department at the German Ministry of Economic Affairs (BMWK) until 2022, where he was involved in developing the National Hydrogen Strategy.

The best-known HIF plant is Haru Oni (southern Chile), which produces e-gasoline for Porsche, among others, via methanol synthesis. However, it is only a pilot plant so far. The prospects of the project, which is funded by BMWK, are unclear.

According to the brochure, 130,000 liters per year are to be produced initially after the first expansion phase. To put this into perspective: at this rate, it would take over 900 years to fill a medium-sized oil tanker for the journey to Porsche at Stuttgart-Zuffenhausen.

But HIF is planning to build much larger production plants, including in the USA, Australia and again in Chile. The largest plant is to be built in Texas (Matagorda). According to initial plans, it will produce 1.4 million tons of e-methanol from green hydrogen, in particular for the chemical industry, but also for shipping and road transport. However, a final investment decision (FID) is still pending.

In Matagorda, too, the question arises as to where the CO2 is to come from. Several large Japanese corporations (Idemitsu, MOL, Jogmec) have invested in HIF Global and are currently developing a plan to capture CO2 from Japanese industrial sites and ship it to HIF’s e-fuels plants.

If they go ahead with their current plan to burn green ammonia from overseas in Japanese coal-fired power plants, this would be another time that Japan has won my special award for original, but ultimately ineffective climate solutions. The Japanese fossil CO2 is ultimately released unfiltered into the atmosphere when the end user burns the e-fuels.

3.3 The focus is elsewhere: ammonia

Global project surveys show where the focus will be over the next ten years: according to an IEA overview from early 2024, around 90 percent of the planned projects aim to produce ammonia, either green ammonia (electrolysis hydrogen) or blue ammonia (natural gas plus CCS).

The focus on ammonia (NH3) is not surprising: for one thing, project developers avoid the vexing problem of CO2 procurement. For another, there are a whole range of possible uses for e-ammonia. It can be sold, like conventional ammonia, to the huge market for nitrogen fertilizers or it can be used in the chemical industry.

Or the hydrogen contained in ammonia can be extracted, so that e-ammonia only serves as a carrier for H2.

However, this requires the construction of large ammonia crackers. So far, they only exist on the drawing board. Large crackers are uncharted technical territory. Moreover, cracking will not be cheap.

E-methanol may have better chances in China. There has been experience with the use of methanol from coal gasification since Mao’s time. The rapid expansion of solar and wind power is now opening up the option of producing green hydrogen at relatively low cost in peripheral provinces. At the moment, however, the climate benefit of these large-scale projects is still unclear, as too little is known about the plans for CO2 procurement.

4. Outlook

4.1 Quantities

Even if the ramp-up of e-fuel production is successful in the next few years, they will only represent a niche solution until 2040. Due to the extreme energy losses, their widespread use requires very large quantities of electricity and the construction of a large number of expensive industrial plants.

The IEA calculates that around 15,000 TWh of green electricity will be needed to supply global air traffic with e-kerosene alone. In addition, there is the construction of electrolysers, complex FT plants, the difficult provision of CO2, the transport problems and much more.

By way of comparison: Germany generates a total of approx. 500 TWh of electricity. Only half of this is green electricity (PV, wind, biomass, hydropower). So, in mathematical terms, 60 “German Energiewende“ would be needed worldwide to convert only air transport to e-fuels.

And that would only be airlines. The fuel demand for maritime shipping is almost as high as that for air traffic. Fuel demand for road transport is about seven times greater than for aviation.

4.2 Cost

The introduction of e-fuels would also result in a huge jump in costs. Fossil gasoline currently costs €0.48 per litre at the wholesale level (Eurobob ARA Barge). E-Gasoline is expected to cost around €3.0-4.0 per litre, according to many model calculations.

E-fuel producers are reluctant to reveal their costs. As a result, there is almost no reliable data on the actual and not just modeled production costs of e-fuels. The profit-conscious oil companies, which are quite active in the biofuel sector, are therefore still giving e-fuels a wide berth.

Cost reductions to €1.5-2.0 per litre over the next decade have been mentioned, but they depend above all on hydrogen rapidly becoming much cheaper. After the first rather disappointing hydrogen projects, however, this does not appear to be the case. Green and blue hydrogen could remain much more expensive and much scarcer than expected for a long time to come. And did I mention the CO2 procurement problem?

The true production costs for e-fuels will only become apparent in practice. Experience shows that it is likely to be more expensive than expected. And these are only the costs: market prices could be significantly higher. Any state CfD budget that sought to cover the difference between fossil fuels and e-fuels would be depleted in no time due to the enormous consumption volumes and the enormous cost range in transport markets.

5. Conclusion

The often-heard claim that regulatory incentives are all that is needed to help e-fuels achieve a breakthrough especially in road transport is far removed from reality.

That is not necessarily bad news: a much more attractive technological path is already available in the form of electric cars and trucks. The industry is aware of this: it is no suprise that so little is being invested in the global e-fuels sector.

Further reading:

IEA: The Role of E-Fuels in Decarbonising Transport, Paris January 2024.

Image Licenses:

Shutterstock 2097625705; 2294548069; 2430562271

Schreibe einen Kommentar