In 2025, low-carbon fuels will have to deal with fierce price competition from fossil fuels. The current situation on the global crude oil market points to a growing oil supply with only a moderate increase in oil demand.

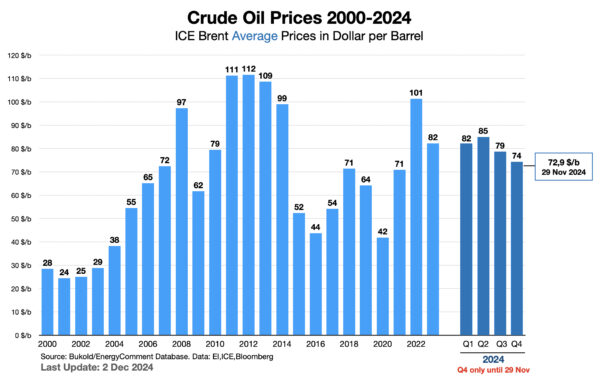

Inflation? Not an issue for the crude oil market. The chart below shows a fluctuating but stable crude oil price over the years.* The average price for the current year is around 80 $/b – slightly below last year´s 82 $/b.

This is a price level that was quite common almost 20 years ago and was often exceeded until the start of the shale oil revolution (from around 2013). Excessive sympathy for the oil companies would nevertheless be misplaced, as technical and organizational advances have significantly reduced the costs of exploration and production of crude oil after 2014.

After 2013, OPEC fought with varying degrees of success against the US oil glut and the temporary collapse of individual markets in the pandemic years 2020-2022.

Even Russia’s attack on Ukraine and the EU’s oil sanctions against Russia were only able to lift the price of crude oil above the USD 100 mark for a few months. In the meantime, Russian oil exports have returned to their usual level, albeit supplying more distant markets such as India and China. The situation is similar for the oil exporters Iran and Venezuela, which are also subject to sanctions. Here too, Chinese refineries are the free riders, benefiting from probably considerable price discounts.

Since then, the global oil market has not experienced a single major supply disruption. Quite the opposite: the oil supply from the “Americas”, i.e. the USA, Canada, Brazil and, more recently, Guyana, continue to put pressure on prices. The bloody conflicts in the Middle East have so far had no significant impact on the oil market, apart from alternative tanker routes.

Demand is also rising, but only slowly at an expected 0.9% this year (more on this in a few days).

This in turn is slowing down crude oil purchases by refineries. Gasoline margins in particular have been falling since the summer. The situation for diesel has recently become more stable.

Against this backdrop, most market observers expect crude oil prices to remain low in 2025. If there are no major supply disruptions, prices could even fall and remain below the USD 70 mark for some time. Following major production cuts, the OPEC+ cartel (i.e. the old OPEC plus Russia, Kazakhstan and others) has maneuvered itself into a strategic impasse from which it can only emerge with difficulty.

This means growing challenges for low-carbon fuels in transportation and in other fossil oil markets. For road fuels, the trend towards BEV/PHEV could stall, at least in Europe and possibly also in the USA, after the change of government. Shipping lines are experimenting with new fuels, but when in doubt, they prefer to order LNG drives instead of the even cheaper fossil natural gas. Progress in air traffic is also slow.

On the other hand, the number of interesting and promising technical and organizational concepts for road, air and sea is growing by the day. We will keep you up to date!

* Measured here using the global marker Brent, i.e. the cheapest grade from several North Sea fields (including Brent) and American WTI Midland. Brent crude oil is still the most important benchmark for crude oil prices. Many other types define their value per barrel as a differential price, e.g. “Brent minus 2 dollars”. However, experts recommend not thinking too long about the way prices are determined in the Brent market. The system is complex and not very transparent, but there is no better alternative.

© Image: Shutterstock License 551816554