The excitement about low-carbon fuels in transportation, such as SAF aviation fuels or HVO road fuels, often obscures the scale and market dynamics in transportation fuel markets.

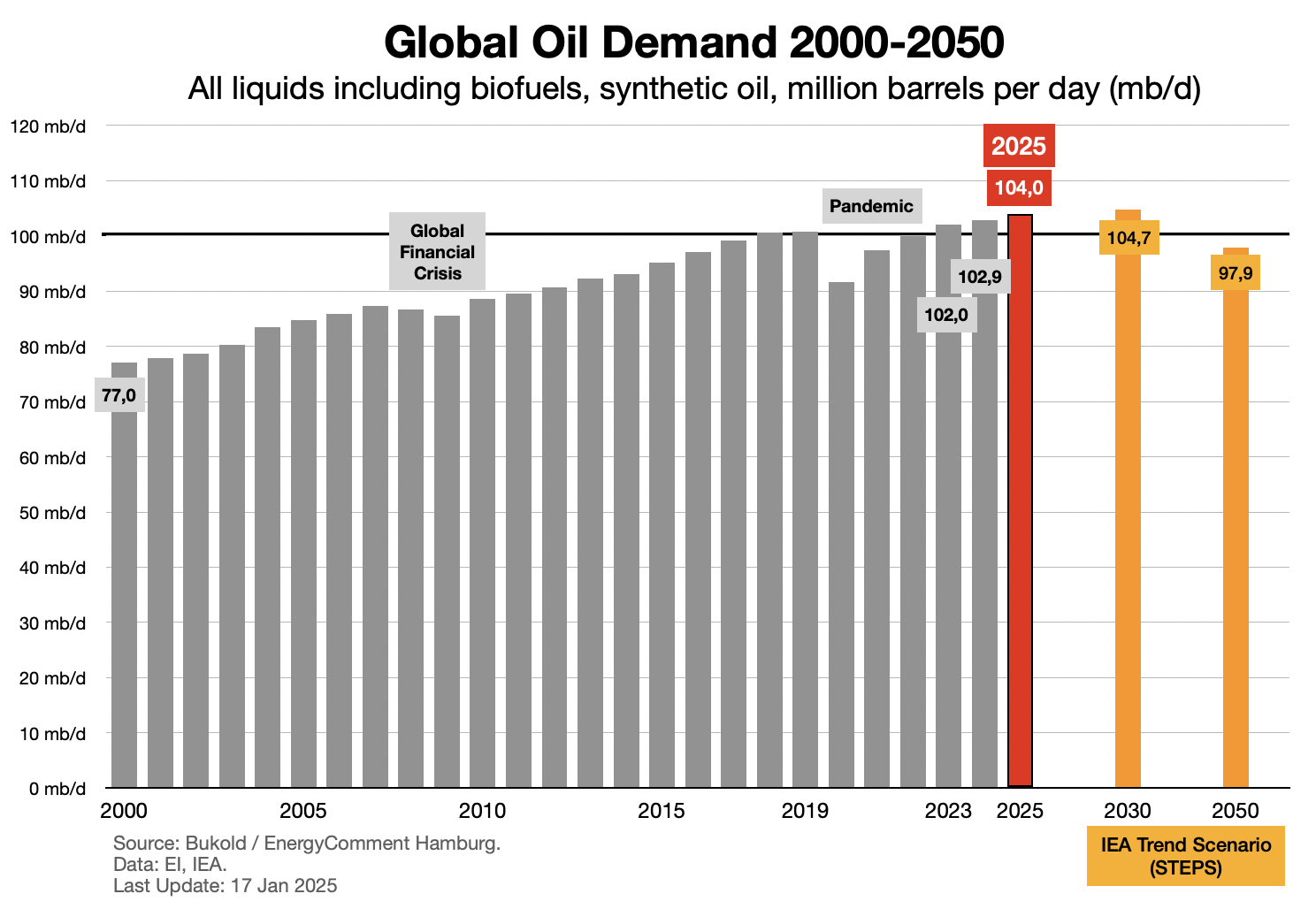

To give an example: Consumption in Indian aviation alone is currently increasing by 0.02 mb/d (million barrels per day) per year. This is a negligible figure in the global oil market, which serves a total demand of 103 mb/d.

Nevertheless, the annual growth in Indian jet fuel demand alone is equivalent to the total global SAF consumption last year. Low-carbon transport fuels are growing, but the fossil fuel market continues to grow much faster in terms of volume.

The following overview will therefore first look at the general development of the global oil market.

In the coming weeks, we will then present the individual transport markets and fuel markets in detail as part of our Transport.Fuel.Tracker.2050 project.

„The annual growth in Indian jet fuel demand alone is equivalent to the total global SAF consumption last year“

Total Oil Demand in 2024 and 2025

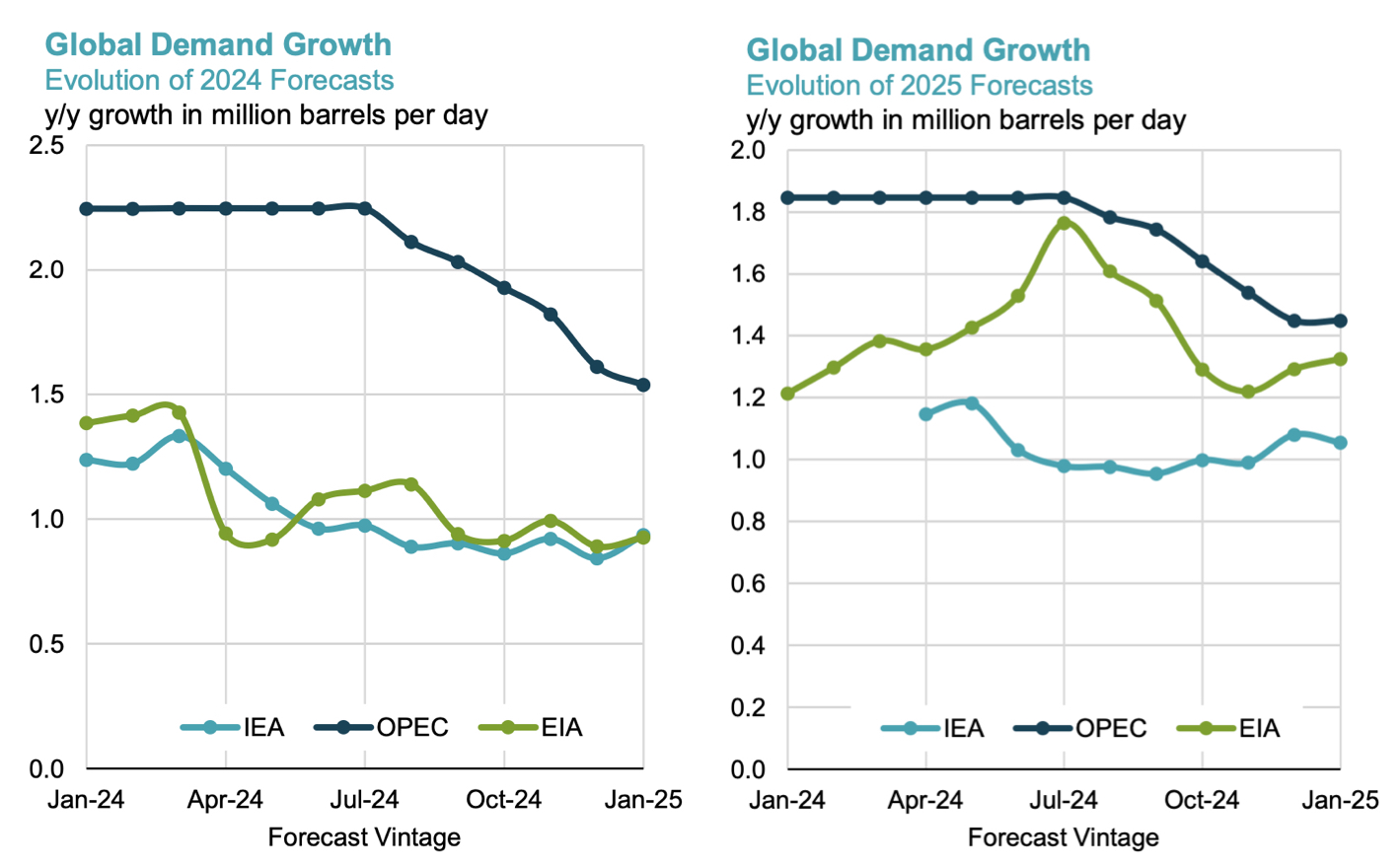

The three major (semi-)governmental oil market observers IEA (Paris/OECD), EIA (Washington, D.C.) and OPEC (Vienna) have continued to adjust their estimates and forecasts since our last article in October.

1. The IEA has only raised its forecast very slightly by 0.1% for 2024 and also for 2025. Global demand for oil was significantly higher than expected in the fourth quarter of last year. Colder-than-expected weather across the Northern Hemisphere, a boom in the US petrochemical industry and low oil prices fueled consumption.

The estimate for global oil demand in 2024 is now at +0.9 mb/d and the expectation for 2025 is +1.1 mb/d, adding to an annual average total of 104.0 mb/d in 2025. BTW: In our future articles we will use IEA numbers as reference source.

2. The EIA also expects +0.9 mb/d for 2024, and a plus of 1.3 mb/d for 2025.

3. The OPEC Secretariat, which expected growth to be almost twice as high as the IEA until a few months ago, has rowed back as expected. However, they still use unrealistic figures for 2024. The current estimate for 2024 is +1.5 mb/d. For 2025, another plus of +1.5 mb/d is expected.

Evolution of Forecasts for 2024 and 2025

Source: IEF

The estimates of major consultant firms in the oil market are similar to the numbers of IEA, EIA and OPEC, albeit mostly at the upper end.

If there are no major disruptions in the global economy, global oil demand in 2025 and probably also in 2026 will climb at a similar rate to last year. Annual oil demand growth will therefore remain at around 1.1 mb/d, or about one percent per year.

Annual oil demand growth will therefore remain at around 1.1 mb/d, or about one percent per year, in 2025.

Even with a good harvest, the quantity of biofuels can only increase from 2.3 to 2.4 mboe/d (boe = barrels of oil equivalent), meaning that 90% of the additional quantities will be fossil fuels.

Converted into GHG emissions, this will result in an additional climate impact of some 100-110 million tons of CO2 or 130-140 million tons of CO2 equivalents if upstream and downstream emissions are also taken into account.

Oil Supply – No Shortages Expected

The oil supply expected for 2025 will be sufficient to easily cover the rising demand for oil. This also applies to refinery capacities. Closures in Europe will be compensated for by new large-scale plants in Nigeria and Asia.

There are currently no major supply disruptions. However, it remains to be seen how the new US sanctions against 160 oil tankers in the Russian shadow fleet and the sanctions announced by the new Trump administration against Iranian and Venezuelan oil exports will affect export volumes.

The OPEC+ oil cartel (“Declaration of Cooperation Countries”) apparently intends to maintain its current production cuts for the time being and not relax them.

The amount of unused reserve production capacity will therefore remain at 4-6 percent of global oil demand for the time being. Even larger outages could be compensated for, including an extensive shortfall in Russian oil exports (crude/products).

Demand for transport fuels in 2025

The weak state of the global economy and the continued growth in electromobility will ensure that the consumption of transport fuels remains moderate overall, according to the IEA in its latest monthly report.

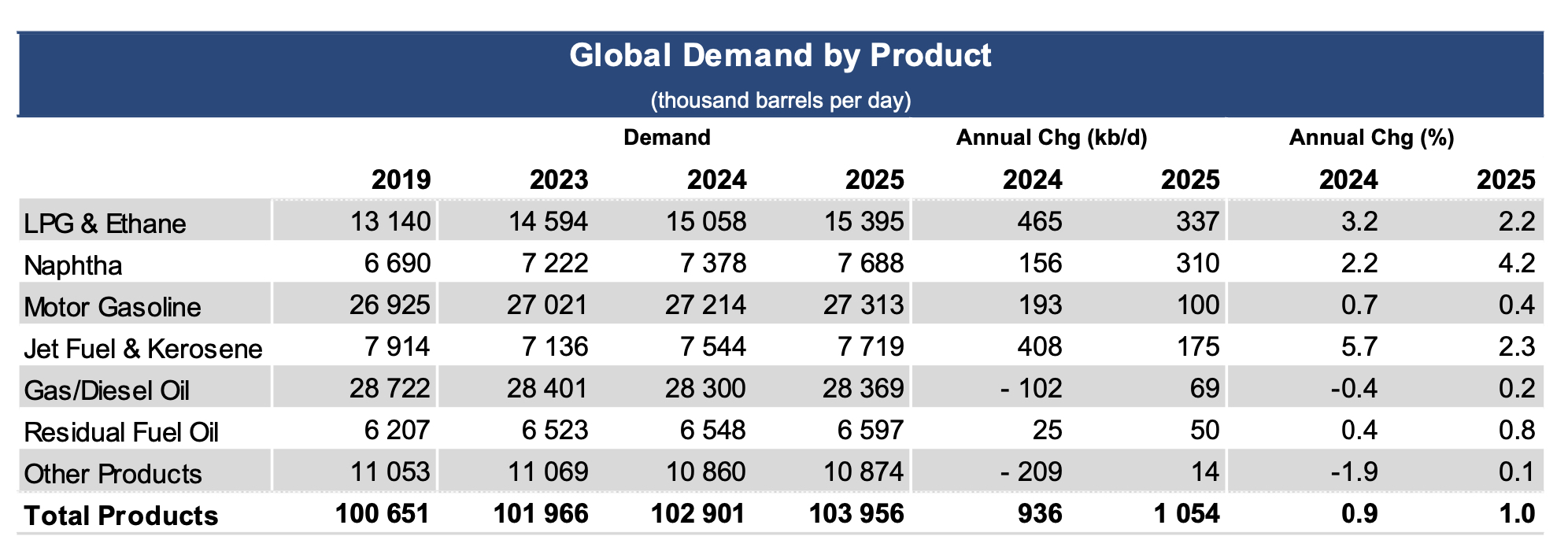

1. As for Motor Gasoline, the IEA expects an increase of 100 kb/d (100,000 barrels per day) in 2025 after stronger growth of 193 kb/d last year (see also table below).

2. Growth is significantly stronger in the jet fuel/kerosene product group, which is primarily characterized by aviation fuels, but also includes kerosene for cooking and other purposes. Growth of 175 kb/d is expected here in 2025 after a (post-pandemic) jump of 408 kb/d last year.

3. The gas/diesel oil product group contains not only transport fuels, but also many applications in the industrial sector. The share of diesel transport fuel in this group is 60-70 percent on average. The economic weakness is having an impact on this broad product group, so that only minor changes are expected (2024: -102 kb/d; 2025: +69 kb/d)

4. In the residual fuel oil product group, it is also difficult to allocate to transport fuels. In addition to marine bunkers, there are a number of other areas of application. However, it is safe to say that consumption of marine fuels increased last year, not least due to the disruptions in the Red Sea. The situation could ease somewhat this year.

The list makes it clear that transport fuels will continue to contribute significantly to the rising demand for oil in 2025. This applies above all to jet fuel and motor gasoline.

Jet fuel continues to be in high demand worldwide. Motor gasoline is benefiting in Europe from the declining attractiveness of diesel cars, but is coming under pressure in China due to the rapid growth in electromobility.

China and India

China and India are the regional mainstays of growing oil consumption

China´s oil demand is supported by strong air travel demand and on-road diesel and trucking. The latest numbers for November 2024 suggest a year-on-year (yoy) decline in motor gasoline demand from 3.32 to 3.26 mb/d and an increase in jet fuel/kerosene demand from 1.03 to 1.11 mb/d.

In India, on the other hand, demand for all transport fuels is climbing, including motor gasoline. As for November 2024, the cumulated increase of jet fuel/kerosene, motor gasoline and diesel is estimated at 270 kb/d yoy.

There is also a rapidly increasing demand for bitumen for road construction in India. The year-on-year demand growth is estimated at 70 kb/d. (source: OPEC MOMR January 2025)

Source: IEA January 2025

Main Sources:

IEA: OMR January 2025, Paris 2025

EIA: STEO October 2024, Washington, D.C., 2025

OPEC: MOMR October 2024, Vienna 2024

IEF: Comparative Analysis of Monthly Oil Market Reports, Riyadh 2025

Schreibe einen Kommentar