Author: Dr Steffen Bukold (EnergyComment Hamburg)

This article is part of our new long-term project Fuel.Tracker.2050

The current situation on the global oil market

The growing tensions in the Middle East triggered a jump in oil prices towards USD 80 per barrel ($/b) at the beginning of October. However, after just a few days, the price of Brent crude oil slipped back towards 70 $/b.

The dominant theme was and remains the unexpectedly weak demand for oil in conjunction with the constantly growing oil supply. There have been no major supply issues, apart from occasional interruptions to exports from Libya and brief outages caused by hurricanes in the Gulf of Mexico. All three oil exporters sanctioned by the West (Iran, Venezuela, Russia) have been able to stabilize their oil exports at a high level. Russia exported 7.5 mb/d in September, of which 4.8 mb/d was crude oil and 2.7 mb/d oil products, according to the IEA in its latest monthly report.

The expanded OPEC+ oil cartel (in its own jargon: Declaration of Cooperation, DoC) is faced with the dilemma of either giving up further markets or risking a further fall in prices through the planned easing of production cuts. Some prestige projects, as well as industrial projects intended to alleviate the one-sided dependence on crude oil exports, have already fallen victim to the red pencil or have been postponed for the time being – which often amounts to the same thing.

Whatever course OPEC takes in the coming months: The amount of unused reserve capacity will remain at 4-6 percent of global oil demand for the time being. Even longer unplanned outages could be compensated for, including an extensive shortfall in Russian oil exports (crude/products), for example.

However, the very moderate level of oil prices are double-edged for energy importing regions such as the EU. On the one hand, the price slump expands the financial leeway of states and private households. On the other hand, they are making the transition from fossil fuels to more sustainable solutions more difficult, for example in the area of contracts for difference or electric vehicles .

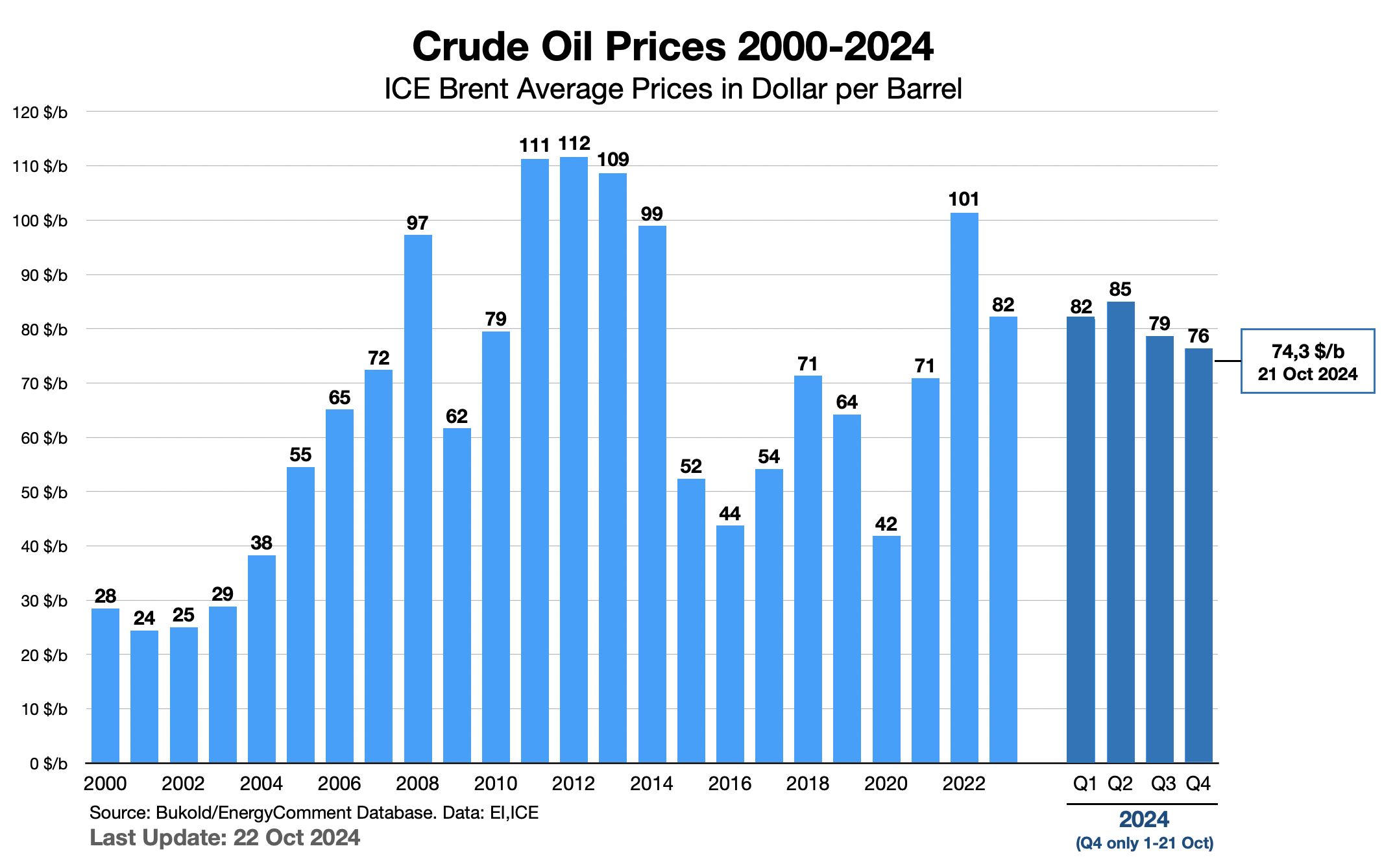

Oil prices

The average price of crude oil (ICE Brent front month) in the current quarter has so far been 76 $/b. If there are no major distortions, the full year 2024 is heading towards an average price of around 80 $/b. In nominal terms, this is in the mid-range of the last two decades, but in real inflation-adjusted prices it is far below the prices paid in the past two decades.

BTW: The paper oil markets presented an unusual picture in mid-October: Never since records began have speculators (hedge funds/CTAs) shown such a pessimistic attitude towards oil at the ICE and CME/Nymex commodity exchanges. Hedge funds are traditionally “long”, i.e. they bet on rising oil prices and thus become the natural counterparties of oil producers who want to hedge their positions. At the moment, however, speculators are adopting a rather neutral stance. The daily ups and downs of prices on the oil exchanges are therefore largely in the hands of “algos”, i.e. computer-aided trading systems that only jump on short-term trends, thereby reinforcing them.

Oil demand 2024

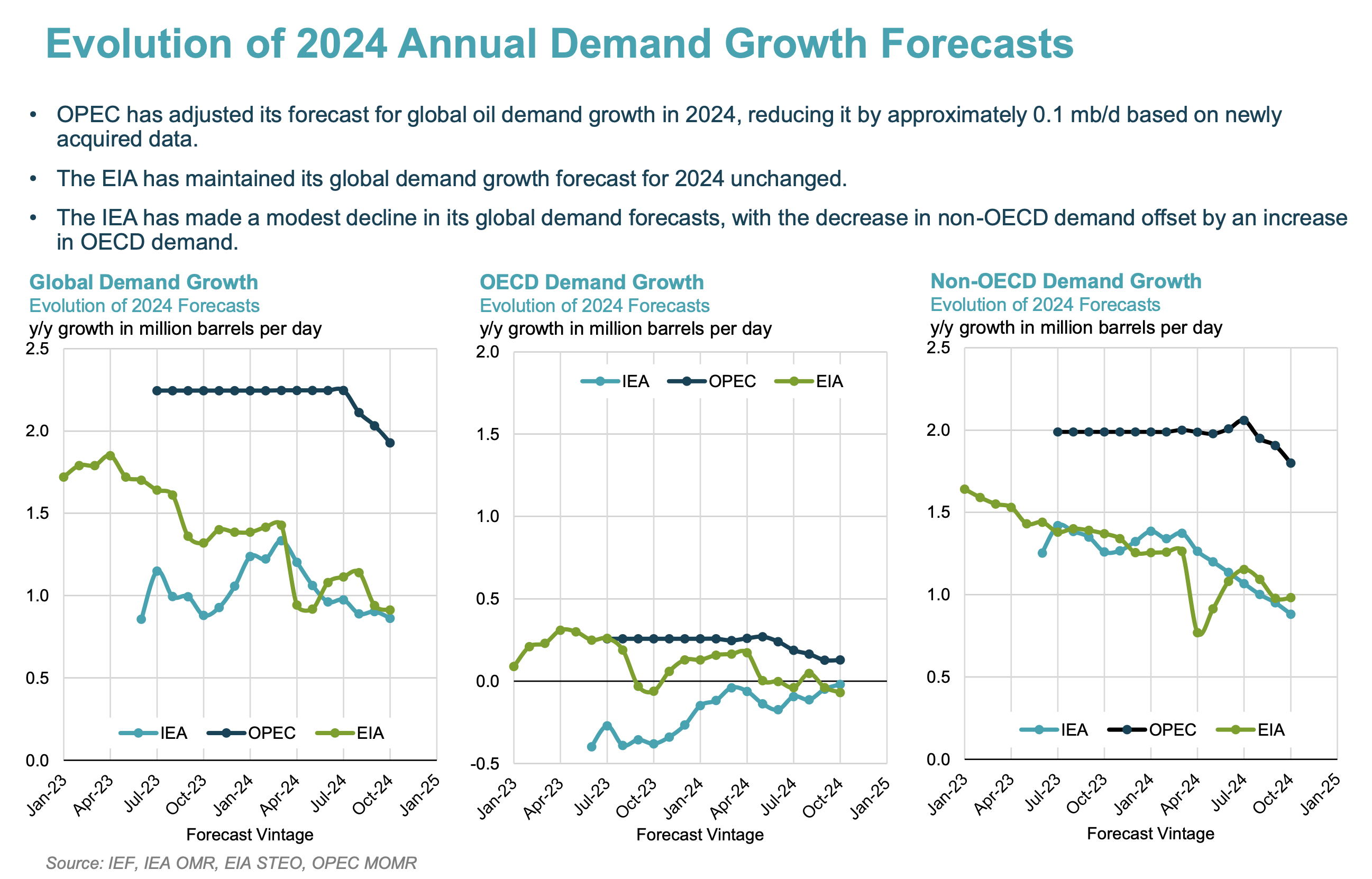

The three (semi-)governmental oil market observers IEA, EIA and OPEC have adjusted their forecasts for the years 2024 and 2025 in their latest monthly reports. According to the latest forecasts, additional demand for oil will be significantly lower than expected only a few months age. The main reason for this in all reports is the growth problems in China, particularly in the construction industry, retail and the financial sector.

However, even for the current year 2024, there are still significant differences between the institutes:

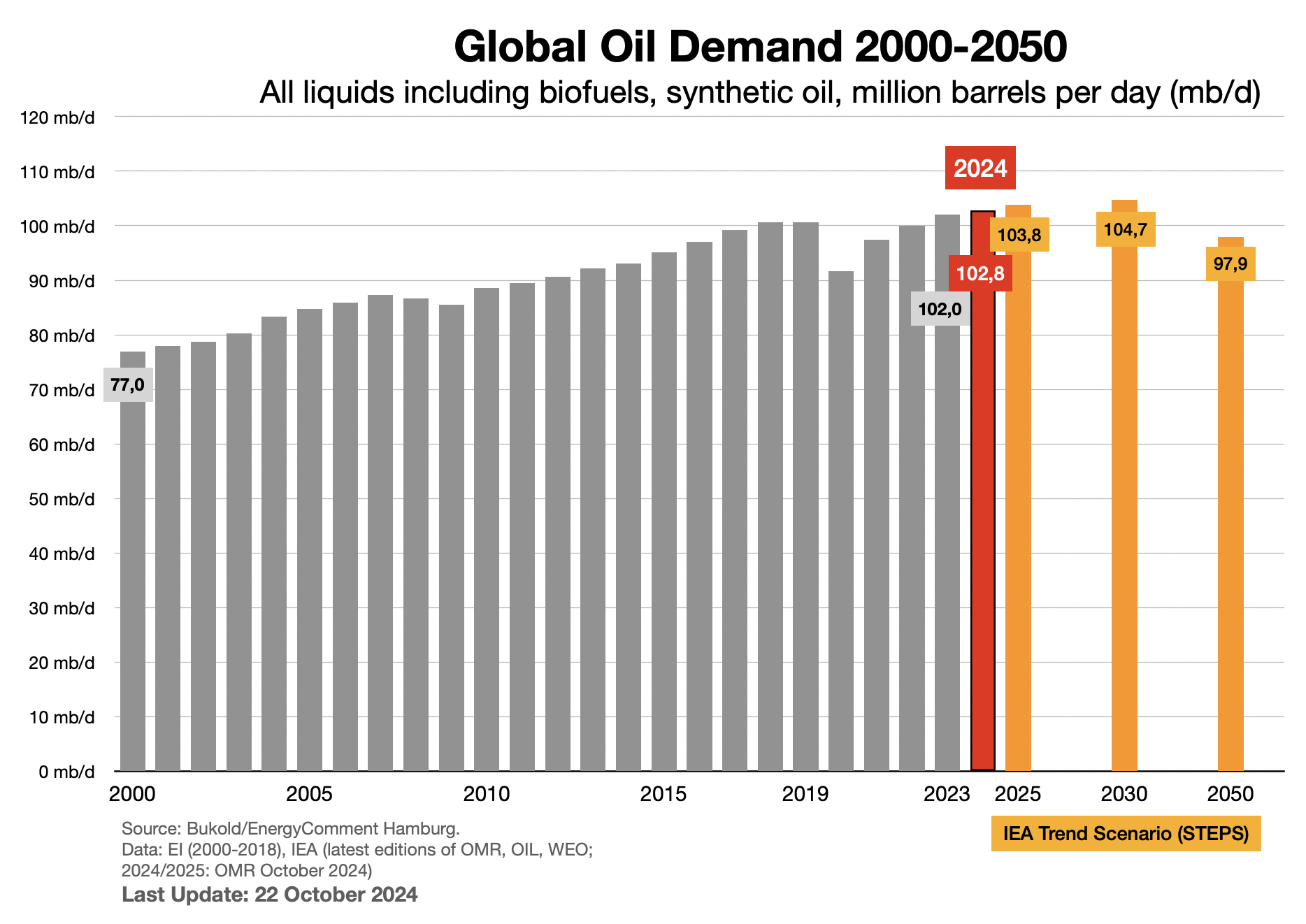

- The IEA (OECD/Paris) is only forecasting growth in global oil demand of 0.86 mb/d (million barrels per day), i.e. from 102.0 to 102.8 mb/d. An increase of 1.0 mb/d was expected in the summer.

- The US energy authority EIA comes to a similar assessment with an increase of 0.9 mb/d in 2024. Here, 1.1 mb/d was still expected in the summer.

- Although the OPEC augurs have also revised their figures downwards, they are still far higher than the IEA and EIA. Instead of 2.2 mb/d, however, a plus of 1.9 mb/d is still expected. This is around 1 mb/d above the other estimates and is considered “outlandish” by many observers. In previous years, the OPEC Secretariat had generally opted for a more realistic middle of the road course, but now risks a loss of reputation.

The following chart shows the development of the IEA (Paris/OECD), EIA (USA) and OPEC (Vienna) forecasts over time. The data was collected by IEF.

Source: IEF

Realistically, it looks more likely at the moment that global oil consumption will increase by just under 1.0 mb/d in 2024, i.e. around 0.8-0.9 percent. Roughly estimated, this will result in an additional 110 million tons of CO2 per year from the combustion of oil and around 130-140 million tons of CO2e if upstream and downstream emissions are added.

Oil demand 2025

Global oil consumption is expected to increase further next year. The current World Economic Outlook of the International Monetary Fund ( IMF ) expects the global economy to grow by 3.2% this year and next. The US, Brazil and once again India are expected to develop particularly strongly. Although growth in China will probably fall below the 5 percent mark, this is still a high figure from a European perspective.

This economic growth will push the dampening factors of oil demand, such as the greater efficiency of vehicles in transportation and the growing number of electric vehicles, into the background (more on this in an article in a few days‘ time).

In short, the IEA expects a jump from 102.8 to 103.8 mb/d in 2025, a new all-time high (see chart below). In its latest monthly report, the EIA comes close to the IEA figures, but is still well above them with a forecast of +1.3 mb/d. The OPEC Secretariat is once again the most optimistic, forecasting +1.6 mb/d next year.

Oil demand 2030 and 2050

The further outlook is very speculative. Global oil demand growth has been remarkably steady over the last 50 years. Even the global financial crisis in 2009 or the pandemic years 2020-2022 only briefly interrupted the rise.

However, other forces are now at work: electromobility in particular is putting road transport on a completely different technological track, jeopardizing almost 44% of global oil demand. Demand for oil is also under pressure in maritime and air transport, residential heating, oil-fired power generation and other sectors (more on this in a later article).

The IEA therefore expects only minimal growth in global oil demand in the coming years, even with stable global economic growth and higher incomes in large emerging economies. In the trend scenario (STEPS) of the World Energy Outlook 2024, it is only minimally above current levels in 2030, but then falls only very slightly towards 97.9 mb/d in 2050. However, the decline could also be much steeper if the climate policy course is tightened. More on this, probable, after November, 5th.

Main Sources:

IEA: World Energy Outlook 2024, Paris 2024

Comments

Eine Antwort zu „Global Oil Demand and Oil Prices (Update Oct.24)“

[…] The three major (semi-)governmental oil market observers IEA (Paris/OECD), EIA (Washington, D.C.) and OPEC (Vienna) have continued to adjust their estimates and forecasts since our last article in October. […]